Introduction

Graphite is quietly emerging as a strategic industrial material in short supply, similar to the rare earth commodities. Years of underinvestment in new supplies, and growing demand sources, have caused prices to rise sharply in the past few years. China, as the world's dominant supplier, has significantly curtailed exports in an attempt to exert greater control in the market. As a result, it's not entirely surprising that the EU named graphite as one of 14 critical materials along with the rare earth elements.

EU Names Graphite a "Critical Material"

A new global rush to find quality graphite supplies has just begun. However, not all graphite is created equally, and there is significant quality variation that determines its price and value, which can range up to a few thousand dollars per ton. When investing in graphite companies, it's essential to find the emerging producers with the right quality graphite to supply the fast growing end markets, assets with proximity to infrastructure, and a management team with skin in the game that can advance the mining project. I believe the two best companies positioned for significant valuation expansion are Northern Graphite (NGPHF.PK) and Zenyatta Ventures (ZENYF.PK).

Overview of the Graphite Market

Graphite, commonly known for its use in No 2 pencils, is quietly finding new applications that are poised to greatly expand its demand in the coming years. Currently, graphite is primarily used in the steel industry where it is added to bricks which line furnaces to provide strength and resistance to heat, used to line ladles and crucibles, and added to steel to increase carbon content. In fact, Japan is the largest world importer of graphite, and will almost certainly boost imports in the coming years as they set to rebuild infrastructure in the wake of the devastating earthquakes they recently experienced. Graphite is also used extensively in the automobile industry in gaskets, brake linings and clutch materials. It has a myriad of other industrial uses including electric motors (carbon brushes), batteries, lubricants and pencils.

Near-Term Demand Driver: Lithium-ion Batteries

However, its largest potential market is for lithium-ion batteries to support increased production of hybrid electric vehicles ("HEV") and electric vehicles ("EV"). It is estimated that there is over 2 to 3 kgs of graphite in a HEV and 25-50 kgs in an EV using lithium-ion batteries. Almost every major automotive producer currently has or is working on an HEV or EV. Examples include the Chevrolet Volt and the Nissan Leaf. Canaccord Capital Inc. estimates that the HEV and EV market will grow to 11 million units by 2015 and that by 2020 the market penetration rate of HEVs and EVs will reach 10-20%. According to Canaccord, this will increase incremental global lithium carbonate demand for battery applications by 286,000 tons. The natural flake graphite required to meet this demand is over 1.5 million tons, which is well above current annual worldwide production of natural flake graphite.

The spherical or potato shaped graphite used in lithium-ion batteries can only be made from flake graphite that can be economically purified to 99.98%C. Only 40% of the one million tons of graphite produced annually is flake and not all is suitable for lithium-ion battery applications. Synthetic graphite offers the only alternative to natural graphite for the manufacture of lithium-ion batteries. However, natural graphite has a performance advantage, although the gap is narrowing, and it is much less expensive as synthetic graphite is made from petroleum coke which is tied to the price of oil.

Future Demand Driver: Graphene

New discoveries in graphene, a derivative of graphite, may greatly expand graphite demand in coming years above and beyond levels currently contemplated. Graphene is essentially the thinnest one-atom thick layer extracted from graphite. Graphene is believed to be one of the strongest, lightest, and most conductive materials and could have major technological applications. The following articles and video illustrate the magnitude of recent research discoveries. The Nobel Prize in Physics was awarded to researchers examining the properties of graphene. While it still may be early to estimate the timing and size of grapheme and its applications making it into commercial production, it's clear that exciting opportunities exist. I encourage you to watch the video posted below to see the exciting applications being worked on.

Flexible Touch Screen Made with Printed Graphene

Future Demand Driver: Pebble Bed Nuclear Reactors

Another potential major demand driver in the coming years may be from the growth of Pebble Bed Nuclear Reactors. A Pebble Bed Reactor ("PBR") is a small, modular nuclear reactor. The fuel is uranium embedded in graphite balls the size of tennis balls.

PBRs have a number of advantages over large traditional reactors in addition to their lower capital and operating costs. First, they use an inert gases rather than water as a coolant. Therefore, they do not need the large, complex water cooling systems of conventional reactors and the inert gases do not dissolve and carry contaminants. Second, its passive safety removes the need for redundant active safety systems. In other words, a PBMR cools naturally when is shut down. Finally, PBRs operate at higher temperatures which makes more efficient use of fuel and they can directly heat fluids for low pressure gas turbines.

The first prototype is operating in China and the country has firm plans to build 30 by 2020. China ultimately plans to build up to 300 gigawatts of reactors and PBRs are a major part of the strategy. Perhaps, this explains why China has significantly tightened its grip on its own graphite supplies and been restricting world exports. Small, modular reactors are also very attractive to small population centers or large and especially remote industrial applications. Companies such as Hitachi are currently working on turn key solutions. Researchers at West Virginia University estimate that 500 new 100 GW pebble reactors will be installed in the US by 2020 with an estimated graphite requirement of 400,000 tons. This alone is equal to the world's current annual production of flake graphite without taking into account PBMR demand from the rest of the world, growing industrial demand and growing demand from other applications such as Lithium-ion batteries. It is estimated that each PBMR requires 300 tonnes of graphite at start up and 60-100 tonnes per year to operate.

Graphite is in the Early Stage of its Cycle like Rare Earths Were in 2009

The U.S. Geological Survey provides an excellent overview of the current state of the Graphite market:

The U.S. has no current production, and is entirely dependent on imports. China, Canada, Mexico, Brazil and Madagascar account for 98% of the total tonnage produced. While China produces an estimated 80% of the world's graphite, it only exports 40% of production due to its own internal domestic consumption. In addition, China currently imposes a 20% export duty and a 17% value-added tax on graphite, and an export permit is required. Given stagnate graphite prices for most of the past decade, Chinese production is at similar levels to 2001. Lack of investment and mine planning, the closure of marginal operations and the fact that mines are getting deeper and older, leads to questions about the ability of supply to increase in the coming years to meet expanding demand. The recent increases in graphite prices are signaling the impending supply/demand imbalance.

According to a recent report by Industrial Minerals magazine, the global graphite market is experiencing a "limited availability" of material and that "the days of cheap abundant supply from China is over" as demand and prices continue to surge. Prices for a range of grades have continued to rise since the start of the year as supplies from China, the world's biggest graphite producer, have experienced shortages owing to seasonal shutdowns over the winter period and restricted supply. All graphite mines from the main mining area in Hunan province in China have been closed for extended periods, constraining supply. The Hunan province, usually producing 200,000 tpa or more amorphous graphite a year, has been very strictly controlled since September 2010.

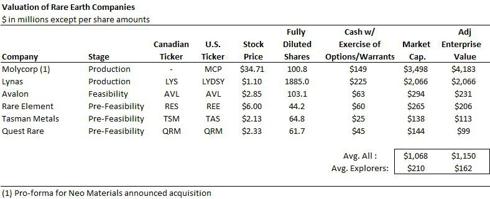

I believe the Graphite cycle is now where Rare Earths were in 2009. The companies that were early to identify and progress their assets saw significant valuation expansions. Take for example Avalon Rare Metals (AVL). Its market cap was tiny at under $50m in 2008-2009. As the world started to realize China's dominance in rare earth would cause major strategic shortages, AVL saw its market cap swell to nearly $1 billion even though they'd never produced 1 ounce of material. Today, the company still boasts a $300 million market cap and is still years away from production. AVL was viewed as a first mover in the emerging producer stage, much like NGC is today. Numerous other companies followed AVL in announcing rare earth finds, raising capital and listing their shares. Today AVL is joined by other explorers such as Rare Element Resources (REE), Tasman Metals (TAS) Quest Rare Minerals (QRM). Molycorp (MCP) and Lynas (LYSCF.PK) who quickly made it into production by re-starting old mines now carry billion dollar valuations. Nonetheless, the aspiring rare earth explorers still have large enterprise values in the hundreds of millions, and are still years away from production.

Click to enlarge.

Two Companies Positioned to Benefit from the Graphite Boom

Below I've outlined my two favorite graphite investments, each for different reasons, but both with significant upside potential.

Northern Graphite (NGPHF.PK)

Northern Graphite is by far the blue chip graphite investment in Canada. The company has a large, well-known deposit called the Bissett Creek project. Below I summarize the key highlights of the company and its asset.

Key Highlights

- Right Quality Graphite: The graphite at Bissett Creek has proven to be large-flake graphite capable of producing graphene and spherical graphite. This is the rarest and highest priced product that is necessary to meet stringent manufacturing requirements in the fast growing segments of the market.

- Strong Partnerships: Leading developers have been signing up to secure partnerships with NGC. This includes a recently announced deal with Panacis, a global leader in high performance Lithium Polymer battery-based energy storage systems and supplier to the military, telecom, medical and renewable energy markets. NGC has also formed a partnership with Grafen Chemicals for graphene research and will retain a 50% interest in the North American patent rights to any products or processes developed by Grafen

- Low Project Risk: The project is low risk because it is in Canada, the graphite is close to a major highway, above ground, conventional mining, and has all the necessary infrastructure available.

- Advanced Timetable: NGC is the most advanced junior mining company in the graphite market having started the project well ahead of others. They are already at the stage of receiving a Bankable Feasibility Study. Once received, they will be in a strong position to attract an off-take agreement with a strategic partner and receive bank debt financing.

- Attractive Economics: The capital costs necessary to bring the mine into production are low by mining standards at around $85m. With a 40 year mine life, 20,000 tons per year of production and current graphite prices, it's entirely possible for NGC to generate $30m per year of cash flow.

- Tight Capital Structure: The company has only 52m fully diluted shares outstanding and has a judiciously raised capital to advance its project. The company recently raised $10.5m at $1.70/share with billionaire Eric Sprott participating. Instead of the stock price going down on announcement, the stock has risen sharply. Depending on the exact outcome of the BFS, there are scenarios where the company may never have to issue another single share.

- Proven Management Team: The company is run by experienced operators in the mining business and has executives with actual experience in the graphite market, and mine development.

It's easy to see why NGC has garnered so much attention from the business and investment community recently. Given the mine current economics, it's entirely possible the NGC's shares can easily double from here to over $6/share. To arrive at this figure, I conduct an NPV analysis with $30m/yr of cash flow, 40 year mine life, and a 10% discount rate. Analysts estimates have been rising recently as the company has delivered successively positive news results that confirm the quality of its graphite. For example, Mackie Research recently upped their price target to $4.40 per share. As the project gets further de-risked with the release of the BFS, and announcement of an off-take agreement, the price targets will continue to rise toward my full valuation.

There are other useful things potential shareholders might want to review as part of their due diligence. For example, the video entitled "The Miracle Material: Graphene" highlights NGC as the one company sitting on billions of dollars of graphite capable of supplying the high growth market for graphene. At the end of the video, there is a partial interview with NGC's CEO.

BNN, the premier business new network in Canada, also recently hosted NGC's CEO last month in an interview. This was a pleasant surprise to see a company with under a $100m market cap to appear on their national TV.

Zenyatta Ventures (ZENYF.PK)

Zenyatta Ventures is less advanced and more speculative at the moment than NGC, but holds potential for much greater upside. The company recently identified what appears to be a very large graphite deposit of high value.

Key Highlights

- Large Asset Potential: The company identified a potentially large graphite deposit in Ontario that is close to infrastructure. The drill holes and tests show a wide range of coarse to fine flake graphite. The graphite is best characterized at the moment as vein graphite, which is quite rare, and only produced in Sri Lanka. More information can be found and the graphite samples viewed here

- Strong and Tight Capital Structure: Cleveland Cliffs (NYSE: CLF), a $10 billion NYSE listed company, owns 11.5% of ZEN's shares. The Management owns 23.5% and institutions own 35%; this leaves only 30% in the public float. When I evaluate small companies, I always want to see a management team that has skin in the game and major institutional support. There are only 39.5 million shares outstanding.

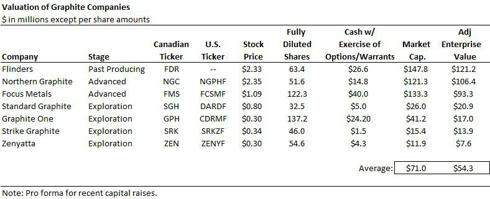

- Attractive Valuation: Zen's market cap is currently $12 million. They have $4.2 million of cash in the bank and no debt. Therefore, the enterprise value is only $7.6 million (see table below). On a relative value basis, I cannot find any other graphite asset in the market as cheaply valued. This means that ZEN can easily triple from here and still be the cheapest graphite deposit on the market.

- Additional Upside in Base Metals: ZEN was initially exploring for base metals on their Albany property when they hit this graphite deposit in their drilling program. These leaves the potential for other discoveries on their property in the future. For a good overview of the company and more information about the graphite deposit, the following article tells the story very well

- Near Term Catalysts: As of the company's last press release in Mid- March, investors should be hearing more from the drilling results any week now. This coming news should provide greater detail about the size, scope, and quality of the graphite at the property. Investors appear to already believe the results will be extremely positive. ZEN's share price has started to increase on significant volume. That being said, the enterprise value is still quite small enough to support significant expansion from here. The company appears to be signaling the results will be very good, and is slated to present at an upcoming conference on graphite in early May. By this time, the results of the additional drilling should be released, and additional investor interest will likely follow.

Summary

The investment community if finally realizing the large supply/demand imbalances that are occurring in the graphite market. I believe we are in the early innings of boom in graphite demand for alternative energy and technology applications, yet the supply-side has failed to adjust because of many years of underinvestment. China's changing policies in the recent years are the main driver; a decade ago, they flooded the market with cheap graphite which depressed prices and suppressed new mine development. Now that China has restricted graphite in a similar fashion to its rare earth policy, graphite prices have risen significantly. The company best positioned to profit from these changing trends is Northern Graphite due to its high quality graphite asset and earliest start towards production in late 2013. Zenyatta Ventures is also an intriguing investment opportunity with its recent graphite find, compelling valuation, and pending catalysts that should unlock value for shareholders.

Disclosure: I am long NGPHF.PK.

Medium term I believe ZEN has a far greater upside as well. Both stocks would make good longterm investments.

ZEN is drilling a large anomaly now, if it runs into more vein graphite and if the anomaly they have identified is all graphite, it will be the largest discovery on this continent. So again, lots of upside but higher risk.

I must also say that the video was pretty neat.

The rising share prices are enabling a huge amount of fund raising and furthering of exploration - this however, as always, will be at the cost of major dilution or future stream discounting to existing shareholders. This is great for the economy but not for anyone hoping to make money off many of these companies.

Moreover, I can see a short term oversupply situation developing rapidly. Look at what the shale gas boom did to natural gas prices. eg. EGR which I just sold last week had a new high quality discovery.

Do you really plan to buy an electric car?

The grandest promises are mostly far off in the future. Electric car's aren't exactly selling like mad. Plus there' always the risk of other emergent technologies blindsiding some of the need for graphite.

Graphene is really cool and offers huge promise - far off in the future and likely long after new reserves have come on stream and crushed the stocks.

Then there is China. If they see their near monopoly eroding, at any time we may find that they've relaxed their controls, worked out major export deals - and THEN announced the regulatory changes. This would crush the market and allow China to move in and pick up the pieces to maintain their monopoly pricing power.

I'd say the current doubling and tripling of prices I've experienced is sufficient to increase near term supply to meet demand if not hurt the commodity's pricing.

Note: I'd looked at Avalon in 2008, 2009 but bought GWG (Great Western Minerals) and owned it on and off. Everyone should look at it as an example of the volatility that you can soon expect in this sector.

However, with that experience under their belts expect investors to be much smarter players in creating a graphite mania and then bailing on it while sticking the novice players with huge losses. This is a VERY unethical, part of the investment world.

So, best of luck everyone in timing the graphite mania.

NGC information is from the NGC website

NCG (ore grade 1.81% / resources are indicated or inferred)

Mesh Size Price ($) Distribution Revenue ($)

+48 Jumbo* 3,500.00 49.60% 1,736.00

+80 Large 2,750.00 26.00% 715.00

+100 Medium 2,250.00 5.50% 123.75

+200 Small 2,150.00 11.40% 245.10

-200 Powder 400.00 7.50% 30.00

Average Revenue/t 2,849.85

*I have given NGC Jumbo flake a 27% price premium over published NGC price of $2,750.

20,000 tonnes * $2,849.85 = $56.9m per annum revenue.

Next, if we take a look at NGC's nearest competitor, Focus Metals (FMS) and how their revenue compares:

FMS information is from the FMS website/SGS NR 10/04/12.

FMS (ore grade 15.67% / resources are measured, indicated and inferred)

Mesh Size Price ($) Distribution Revenue($)

+48/+100 Large 2,750.00 46.10% 1,267.75

+150/+200 Medium 2,250.00 39.00% 877.50

Balance* Sml/Powder 1,275.00 14.90% 189.98

Average Revenue/t 2,335.23

* $1,275 is a simple average of small flake and powder price.

20,000 tonnes * $2,335.23 = $46.7m per annum revenue

NGC certainly do have a good premium on revenue per tonne over the nearest competitor, due to a higher large/jumbo flake distribution (+22%).

But, let us then consider production costs:

There are no public companies producing currently in North America and no published BFS to refer to from either of these mining development companies.

FMS has though had feasibility studies completed in the past and have published an expected production cost of $250/t, based on a 15.67% ore grade on their website. If we assume this information

is optimistic, let us say their cost of production will be $400/t (I'm taking a more prudent approach to FMS).

When you then compare the ore grades 15.67% (FMS) and 1.81% (NGC) it is clear NGC have to mine and process considerably more ore to produce a tonne of Graphite.

For a tonne of graphite NGC must mine/process 55.24 tonnes of ore. In comparison FMS will need to mine/process 6.38 tonnes of ore. NGC must therefore mine and process 8.65 times more ore per tonne of finished product, due to the lower ore grade going into the plant.

Let us then assume that mining and processing 8.65 times more ore does not fully equate to 8.65 times the cost. I think it is fair though to assume at least 5 times the cost, as we have the basic mining cost, grinding and milling, flotation and disposal of waste ore/tailings. To process the ore the plant will need to be considerably larger, with more personnel/higher manpower costs and higher energy costs. The overburden at Blisset Creek (NGC) is also greater, 10m vs Lac Knife (FMS) at 6m, so it costs more to

get at the deposit in the first place for NGC.

NGC could therefore be looking at an estimated production cost in the region of $2,000 per tonne.

8.65 times more mining and processing per tonne of finished product = 5 times the production cost of production (my estimate).

If we then use the FMS estimated production cost of $400 * 5 = $2,000/t for NGC.

So the comparative gross margins for NGC and FMS could stack up as follows on 20,000 tonnes production:

($m) 20,000 tonnes NGC FMS

Revenue (from notes above) 57 46

COS ($2,000/t vs $400/t) -40 -8

Gross Margin 17 38

Gross Margin (%) 30% 83%

The stated capex figures are also interesting and should be challenged. FMS estimate $65m, NGC state $85m.

Is it really possible to set up a plant for 31% greater cost for NGC, that has to process 765% more ore annually to achieve 20,000 tonnes of Graphite production? This looks unlikely to me, so either FMS is potentially over estimating the capital requirements or NGC under estimating the same imo.

A larger capital requirement would then inevitably lead to higher interest payments on a greater debt burden and we must also consider an increased cost of maintenance associated with a larger plant. Costs below gross margin are therefore also likely to be greater for NGC.

There is also an issue regarding sensitivity to price changes. A worsening situation in Europe, a Chinese economic slow down

could all have a negative potential effect on price going forward. New technology may well mean demand continues to grow unabated, but there is a higher risk for the marginal producer with lower gross margin and operating costs.

When I considerer potential production costs for NGC at $2,000/t against an average revenue of $2,849/t, prices do not need to reduce as much for NGC compared to FMS for issues of lack of profitability to arise.

I do appreciate my figures are open to debate. If companies choose to upgrade Graphite to the 99.999% purity range, income will be considerably higher with increased gross margin to match, both companies could choose to upgrade, indeed I feel NGC must provide this type of production to have a robust economic model.

Additionally, my quoted FMS production cost per tonne of $400/t ($250/t stated by FMS, increased by me for prudence) could be incorrect and $250 may be more appropriate, if so the $2,000/t stated for NGC is then also overstated.

Finally the factor I am using of x5 to estimate the NGC cost of production to process 8.65 times more ore may also be inaccurate.

There are favourable aspects to NGC also. They have a considerably tighter share structure and they also have a much larger total resource. FMS on current data have a 40 year mine life at 20,000t per annum. NGC have a mine life of 2,750 years at the same production. There is certainly the opportunity to increase production from 20,000t per annum for NGC, with the associated benefits of econcomies of scale. NGC also look to be 6-9 months

ahead of FMS in production terms, with the early bird advantage.

In summary, when I consider both projects NGC does not look to be the best graphite prospect from an economic perspective both in gross margin and EBIT terms. FMS appears to have a considerable advantage, the reason being that old mining adage of "Grade is King". Whilst my numbers use supposition and must include inaccuracies due to lack of available data, I do think this certainly should give investors something to think about regarding the quality of NGC as a long term investment when compared to its nearest competitor. This is more of an issue once the initial Graphite bubble is over and the realities of economic production begin.

Dislosure:

I am an Accountant and part-time private investor. I own shares in FMS. I do not own shares in NGC.

Wikipedia.http://bit.ly/HCIYlU

Here if found that naturally mined graphite is not the only source of graphite and not even the preferred source of graphite for many high tech graphite products. Instead they use synthetic graphite (which the author seems to have missed in his graphite demand discussion). I also note the American company that discovered and developed synthetic graphite production for the past 125 years - is still a major player in high tech graphite product production - GrafTech:

http://bit.ly/IrDl9H

While natural graphite miners will certainly benefit from growing graphite demand - it might be even more logical that the synthetic graphite producers could benefit most from natural graphite depletion and increased graphite prices.

In any case, a logical graphite investment is not a slam dunk natural graphite mining investment and numerous factors will influence who benefits the most in our new economic paradigm of a resource depletion environment where the key and fulcrum economic resource is generally related also to peak petroluem - fuels for mining, fuels for ore transport, and energy for processing come to mind as being very significant.

For me, some economic and mass balance analysis will be required to see whether synthetic graphite producers are more or less petroleum energy dependent than natural graphite miners and processors. Without this knowledge and for my risk profile, investing in natural graphite miners is essentially uninformed speculation.