Why Patents matter: when 'experts' value a patent portfolio at $290 million and it sells for $1.06 billion, that should be a bright red flag. Aside from expert analysts being wrong, patents are largely misunderstood and hence undervalued. Legal battles range from smiley faces in texting to Java (between Oracle and Google).

Current Patent News: there's one company (Potter Voice) that's battling it out between all mobile operators for voice input (Siri, Microsoft voice, etc). If they win, this could be the jackpot for the people backing Potter Voice.

RIM's patent portfolio is still largely up for debate; I'm hesitant to believe any current valuations simply because the value of patents is so dynamic. It simply is not known until it's scrutinized in court or valued at the point of sale.

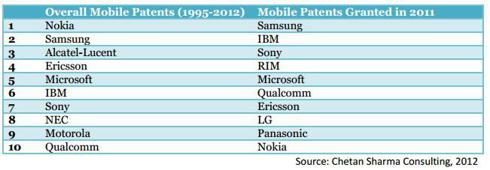

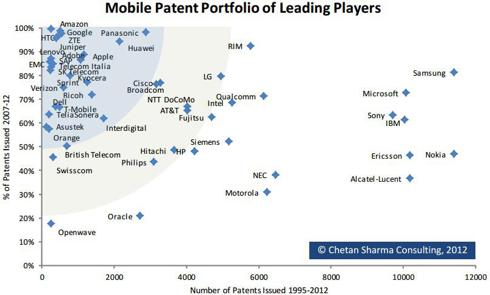

On a research paper provided by Chetan Sharma, in-depth quantitative analysis was done on mobile patents. There were several large companies that came out in the report, but I included those that pertained to the mobile platform space (BB 10, iOS, WP).

Several companies mentioned here include Nokia (NOK), Samsung, Apple (AAPL), Research in Motion (RIMM), Microsoft (MSFT), IBM (IBM), Sony (SNE), Motorola (since bought by GOOG), and Qualcomm (QCOM).

The Report

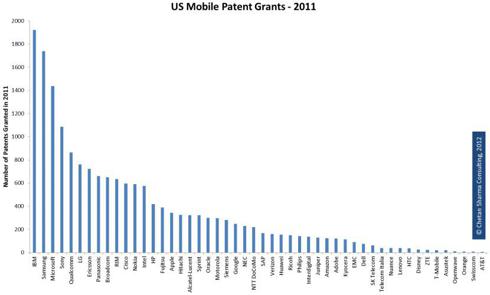

The US Patent Office in 2011 had over 535,000 applications, approximately a 50% increase from 2000. The European counterpart has seen increases at 45% from 2000. Over 7 million patent fillings were analyzed over the past 20 years (1991 - 2012), and this article will largely focus on the quantitative results related to the mobile space and the 4 mobile platforms.

Note: While the research was done in the American and European demesnes, there are other geographical areas that are important but not mentioned.

To say that the mobile space is important is an understatement at best; it's hard to find anyone without any kind of mobile connectivity. Here is where I need to acknowledge a wildcard: Facebook. Their valuation is probably their Damocles at the same time. Facebook has incorporated a new metric for valuing their growth and business. A revenue-per-user ratio shows how much each Facebook user brings in ad revenue a month.

If Facebook is targeted by patent trolls, this valuation tool would be turned on Facebook. If each patent costs the patent owner $0.01 in forgone revenue a month - the present value of 700 million users is quite a hefty sum.

The total number of patents granted to a specific company is not critical to assessing the value of the portfolio, though the bigger the portfolio, it will be typically worth more as well. In legal disputes, usually the larger the number of patents, the more cross-licensing and licensing opportunities arise, and that has yet to be seen.

Click to enlarge.

This shows the overall leaders in patent space. Nokia being the dominant player up until the smartphone revolution should not be a surprise.

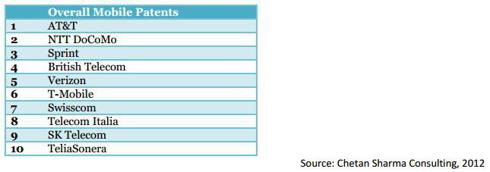

Patents held by telecom agencies related to infrastructure - it's interesting because RIM isn't here (but they're relatively young).

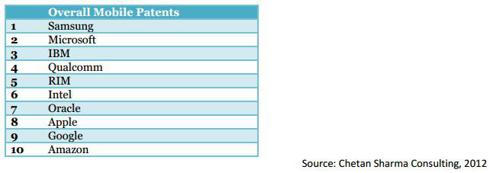

A surprise is that Apple is trailing in at #8. Supporters of Apple believe the company is good because they make the best technology and innovate every day.

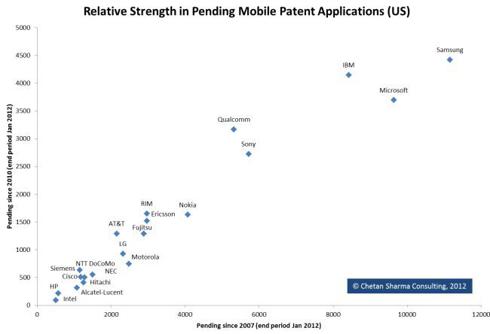

Future Patents

You see Qualcomm and Sony as tier 2 companies. IBM, Microsoft, and Samsung are tier 1. These two groups of companies dominate the patent space.

Note: The other companies are not equal in their patent portfolios or in terms of company maturity.

Behemoths with large portfolios that just started to focus on Mobile: Samsung, Microsoft, IBM, and Sony. These companies have deep pockets, and have been around for a long time. These companies are well defended form litigation (this doesn't mean they aren't targeted), and have built up quite a large base of patents. They can buy patents and expand much faster than any other group. Having deep pockets and an existing large base of patents, they can easily license these patents out and simply rely on the annuity from licensing fees.

Behemoths with smaller portfolios starting to focus on Mobile: Openwave and Oracle fall into this category; they have just started, but are probably the most inclined to just buy up patents, as it would be the easiest way to expand their influence. These companies also have money to buy en masse. We don't know if they have any interest in mobile space currently (Oracle has mentioned there was interest in Palm and RIM at one point).

Mid-tier: Not the most cash infused but with a strong portfolio built over the past decade. This includes Qualcomm, RIM, and Intel. They are probably the worst off because they aren't big enough to be insulated, but are still small enough to be targeted.

Intel wants to become a major player in the smartphone space with their XOLO debut in India in April. Qualcomm is probably content with providing chips, and it's unlikely they would move into the mobile software space. RIM has a pending release of BB 10, with relation to stock price moves, this group and the new group are the most volatile.

New: Apple, Google, HTC, Amazon. Yes, Apple falls into this category. They have only started to build up their portfolio, and if this is any indication of innovation, then people should acknowledge that Apple is a company that repackages existing products and sells them.

The newer group has recently started their involvement in the past 5 years, having more than 90% of their mobile patents granted within that time frame. Rumors of Facebook and HTC working together on the first Facebook phone have surfaced - it would be interesting to see how they handle patent issues, since they both have none. Facebook would have the cash buffer, and it seems logical that they would pay to license patents in the near future.

Google recently bought over Motorola to get into the patent arena and should be pretty content on where it is right now. RIM's OS and Apple iOS are limited to their proprietary devices, and until we see any new platform gaining traction, don't expect Google to make any moves on the patent front.

Market Leaders

There are a few key pictures that show the market leaders. Take note where Google, RIM, Microsoft, and Apple stand, since they are the large platform providers.

Conclusion

Analyst have already valued RIM and its patent portfolio, but AOL's patent sale should be an indication of how wrong current valuations are.

The cash rich companies near the bottom (Apple and Google) have a lot to gain by simply trading cash for patents, and it would seem relatively cheap for them.

The top companies in the last picture are all doing solid with the exception of RIM (tanking in its stock), Sony's mobile department has not been the most successful but it's only a part of Sony's revenue base.

My only two recommendations is to not undervalue RIM's patents and to look for IBM to move into the mobile space. If IBM were to break into the mobile space, be sure to catch on and ride it up. It's pretty scary, once you look at that last graph long enough, to think the companies trailing on the right side could drown in lawsuits.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.