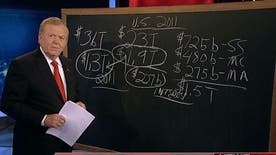

Facebook's willingness to pay $1 billion to buy the 12-person start-up Instagram has Silicon Valley venture capitalists happily re-doing their math on the potential value of hot young companies.

The fact that Facebook was the buyer is itself seen as a big plus for the valuation of startups that may be adding subscribers rapidly but in some cases are still far from being profitable or ready for the public markets.

Until now, "it's really just been Google <GOOG.O>," said Jeremy Liew, a partner at Lightspeed Venture Partners who backs LivingSocial and others. "You really can't get an auction with only one bidder."

The price paid for Instagram, a company with no revenue, will also make it easier for potential acquirers to justify spending big for something perceived as strategic, according to Jeff Clavier, managing partner at SoftTech VC.

Some venture capitalists think Instagram was a one-off. "It's certainly an outlier from a valuation standpoint," said Matt Murphy, a partner at Kleiner Perkins Caufield & Byers who manages its $200 million iFund. "There was a big strategic concern or threat there" for Facebook, he said.

Investors also caution that the dynamics that enable so-called Web 2.0 companies like Instagram to gain huge numbers of customers very quickly can also cut the other way.

One need only look at Highlight, a location-based social application for iPhones that was all the rage early last month and is now almost forgotten, or even Turntablefm, which lets far-flung friends listen to music together and has lost buzz after acclaim last summer.

Still, companies with certain characteristics -- massive growth in users or a competitive edge in mobile applications, for example -- could be in the hunt for a 10-figure payday. Here are some of the hottest prospects:

WHAT IT IS: A virtual pinboard that lets people easily assemble pictures and other bits of content online. Users follow each other, Twitter-style, and comment on each others' pins, which can include anything from hot cars to vacation destinations. The nature of the content makes it e-commerce-friendly, and tremendous growth over the past six months puts it at the heart of the social networking revolution.

"If anyone wanted to make a counter-statement to Facebook, Pinterest would be a good way," said Clavier, who is not an investor in the site.

FUNDING TO DATE: $37.5 million from Andreessen Horowitz, Bessemer Venture Partners and others.

An investor told BusinessInsider last month the company was now worth $1 billion, up from the $200 million valuation it claimed in October at its last funding round.

KEY FACT: User base has grown to 19 million from 2 million in just six months, according to comScore Inc.

WHO ARE THESE GUYS: Founders Paul Sciarra and Ben Silbermann met at Yale. Half the 200 emails Silbermann sent to his friends asking them to join Pinterest at its launch went unopened.

TUMBLR

WHAT IT IS: A blogging service that allows for mixed media posts, such as pictures with short captions.

"It's in the same space as Pinterest," said John Lilly of Greylock Partners, who worked on the $50 million funding round that Instagram wrapped up just before its sale to Facebook. "But it's significantly bigger than Pinterest is on almost every single metric."

FUNDING TO DATE: $125 million from Greylock, Sequoia and others.

In September 2011, Tumblr was valued at $800 million.

KEY FACT: High level of engagement, with users creating 14 original posts each month on average, Tumblr says.

WHO ARE THESE GUYS: Founder David Karp, doing Harvard drop-outs like Facebook CEO Mark Zuckerberg one better, quit the Bronx High School of Science at age 15. Spark Capital and Union Square Capital were two of Tumblr's earliest investors, as they were at Twitter.

EVERNOTE

WHAT IT IS: Software that lets users take notes -- including written text, copies of web pages, or photos -- and then access and search them from anywhere, including phones.

Evernote would make a good acquisition for a company that needs to bolster its cloud capabilities, such as Hewlett Packard Co <HPQ.N>, said a venture capitalist who did not invest in Evernote but wishes he had.

FUNDING TO DATE: More than $95 million from DoCoMo Capital, Sequoia Capital and others.

Around the time of its funding round last summer, the speculation was that Evernote would join the $1 billion valuation club, but according to TechCrunch it did not quite make it.

KEY FACT: 26 million users.

WHO ARE THESE GUYS: The research team is led by Stepan Pachikov, who once worked on the handwriting-recognition technology in the Apple Newton. Internet maven Esther Dyson and PayPal cofounder Max Levchin have sat on the board since 2006.

DROPBOX

WHAT IT IS: A service that allows users to store and share files easily online.

Like Evernote, Dropbox could be a good acquisition for a company that has fallen behind in cloud-based services, but it would be a lot more expensive.

FUNDING TO DATE: $257 million from Index Ventures, Greylock Partners, Sequoia Capital and others.

Dropbox's last funding round in October valued the company at around $4 billion, according to media reports.

KEY FACT: 1 billion files are saved every 3 days on the service, the company says.

WHO ARE THESE GUYS: Co-founders Drew Houston and Arash Ferdowsi both attended MIT; Ferdowsi dropped out.

PINGER

WHAT IT IS: A free text and talk service that operates independently of wireless carriers. The service provides a telephone number when you sign up to make phone calls; the number can connect to public telephone networks.

Pinger works across platforms, including Apple Inc's <AAPL.O> iOS and Google's Android. A disruptive technology in the telecom sector, Pinger could be an attractive buy for a major carrier such as AT&T <T.N> or Verizon <VZ.N>.

FUNDING TO DATE: $19 million from Kleiner Perkins Caufield & Byers, DAG Ventures and Deutsche Telekom.

At its last funding round earlier this year, the company did not disclose a valuation.

KEY FACT: One of the top five installed apps on Apple's iOS platform.

WHO ARE THESE GUYS: CEO Greg Woock used to work for the Virgin Group's Sir Richard Branson; a representative from T-Venture, Deutsche Telekom's <DTEGn.DE> venture-capital arm, sits on Pinger's board.

SPOTIFY

WHAT IT IS: An online music service that was launched in Europe before coming to the United States. Spotify offers free accounts that allow users to play specific songs -- unlike other music services that only allow users to pick stations or genres -- as well as premium subscriptions.

Some are disappointed in Spotify's sales of premium subscription, but others say value lies in its reach. Amazon.com <AMZN.O> or Google could be potential acquirers.

FUNDING TO DATE: $189 million from Kleiner Perkins Caufield & Byers, Accel Partners and others.

Spotify is raising money now at a valuation of more than $3 billion, according to media reports.

KEY FACTS: 7.5 million U.S. visitors just a year after its U.S. launch, according to comScore. Partnered with Facebook for a streaming music service.

WHO ARE THESE GUYS: CEO Daniel Ek founded his first company at age 14, building websites for small businesses. He and co-founder Martin Lorentzon built up Spotify from their native Sweden. Sean Parker, the Silicon Valley consigliere who guided Facebook and co-founded Napster, has played an active role and sits on the board.

-

Vegas' Competitive Adult Pool Industry (Fox Business - Industries)

-

The Ten Most Affordable Cities to Buy a Home (this site)

-

IRS Already Gearing Up for Health-Care Crackdown (this site)

-

Why Gold Will Surge to $3800 per Ounce (www.wholesaledirectmetals.com)

-

Obama Impugns Romney in a Flagrant Abuse of Power (The Fiscal Times)

-

Home values: 5 worst markets (BankRate.com)

-

8 Memory Problems that Could be Signs of Alzheimer's (Caring.com)

-

The Top 10 Highest-Paying Jobs Requiring a Two Year Degree (Madame Noire)

Glad you liked it. Would you like to share?

Comments for this page are closed. Commenting on content automatically closes after three days from when it's published.

Showing 0 comments

You must login to comment.